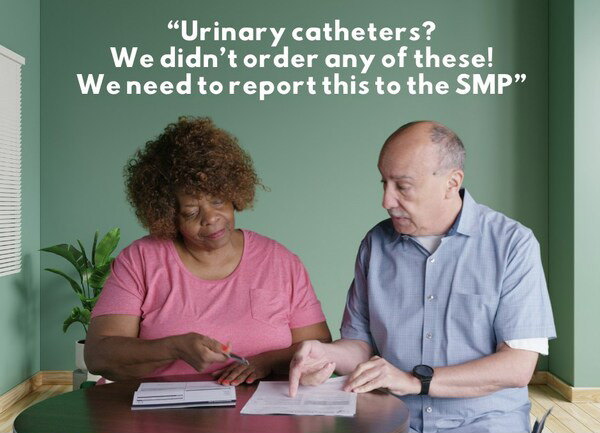

WASHINGTON, Feb. 27, 2024 /PRNewswire/ — Medicare beneficiaries across the country are finding charges worth thousands of dollars on their Medicare statements related to urinary catheters that were not needed or received.

“Scammers are taking advantage of the Medicare program and billing for unnecessary products, which is hurting the program. This is also putting Medicare beneficiaries’ Medicare card numbers at risk and compromising their medical identities,” said Nicole Liebau, director of the Senior Medicare Patrol (SMP) Resource Center. The SMP program, which exists in every U.S. state, Puerto Rico, Guam, the U.S. Virgin Islands, and Washington, D.C., empowers and assists Medicare beneficiaries, their families, and caregivers to prevent, detect, and report health care fraud, errors, and abuse.

SMPs started receiving complaints of urinary catheter claims in May 2023. They saw a handful of complaints per month until August 2023, when the number of complaints jumped 750%. Through the end of the year, SMPs continued to receive a staggering number of complaints, with the highest amount received in December 2023 to date.

The SMP program recommends that people regularly check their and/or their loved ones’ Medicare statements to make sure that Medicare wasn’t billed for items or services that were never requested or received. To learn how to readMedicare statements or get help with a compromised Medicare number, contact your local SMP. They can help you request a new Medicare number and report the claims.

The Senior Medicare Patrol (SMP) is ready to provide you with the information you need to PROTECT yourself from Medicare fraud, errors, and abuse; DETECT potential fraud, errors, and abuse; and REPORT your concerns. SMPs help educate and empower Medicare beneficiaries in the fight against health care fraud. Your SMP can help you with your questions, concerns, or complaints about potential fraud and abuse issues. It also provides information and educational presentations. To locate your local Senior Medicare Patrol, call toll-free 877-808-2468 or visit www.smpresource.org.

Contact Information

Senior Medicare Patrol Resource Center

Nicole Liebau

1-877-808-2468

[email protected]

SOURCE SMP Resource Center